Atiya Mahmood

Environmental Design State Specialist

Do you dream about living in your own home someday?

If so, you're not alone. Each year, many people buy their first home and join the ranks of millions of Americans who are already homeowners. However, the home buying process can be intimidating. For many people, buying a home is the largest purchase they will ever make. Because it is a major decision and requires a lot of commitment, you should understand what is involved and how to navigate through the process from beginning to end.

If so, you're not alone. Each year, many people buy their first home and join the ranks of millions of Americans who are already homeowners. However, the home buying process can be intimidating. For many people, buying a home is the largest purchase they will ever make. Because it is a major decision and requires a lot of commitment, you should understand what is involved and how to navigate through the process from beginning to end.

This guide can help first-time homebuyers understand the home buying process. It helps you determine if your financial resources will allow you to buy a home, offers advice about how to find a suitable home, and tells how to get a mortgage. Finally, it guides you through the process of closing and shows how to protect your investment.

Are you ready to buy a home?

Both buying and renting a home have advantages and disadvantages. To begin the home buying process, determine if the benefits of buying a home outweigh the advantages of continuing to rent.

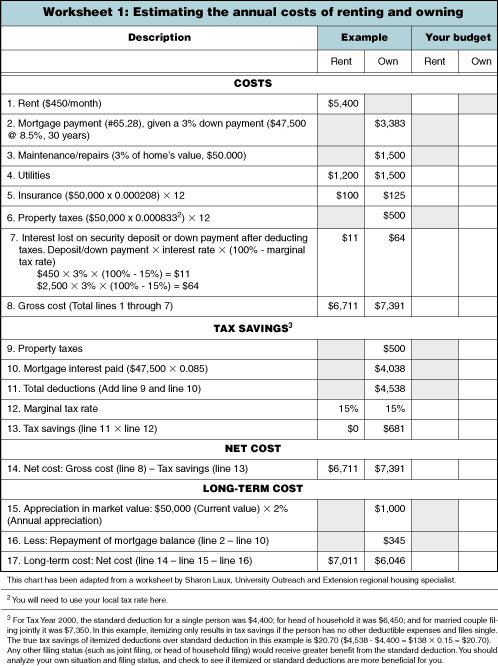

For people who have a strong desire to own their home, are willing to maintain their property, and plan to live in the same area for at least five years, buying a home may be the right choice for them, provided they have adequate financial resources. In order to assess the annual costs of renting and home ownership, fill out Worksheet 1 to determine which route is better for you at this time.

How much home can you afford?

Buying a home is usually a costly endeavor. Nearly every homebuyer needs to finance his or her home. This section will help you evaluate your financial resources, help you estimate how large a loan you can get, discuss several criteria that lenders look for in mortgage applicants, and describe how to get preapproved and prequalified for a loan.

Evaluate your financial resources

Evaluate your financial resources

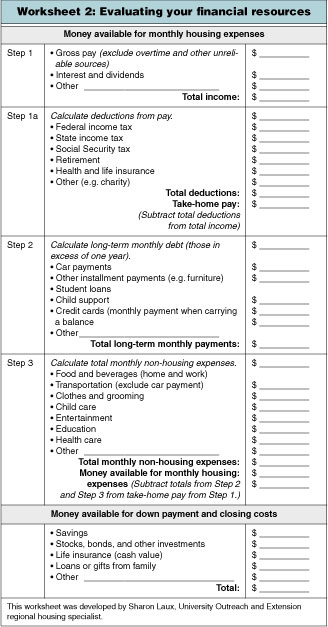

To determine if you have enough money to buy a home, take a close look at your financial resources. How much money do you have saved? How much debt do you have? Worksheet 2 will help you evaluate your current financial situation and determine how much money is available for the monthly payment, down payment and closing costs.

How large a loan do you qualify for?

Several "rules of thumb" are often used to help people estimate the size of mortgage for which they might qualify.

- Lenders will often qualify people to borrow between 2 and 2-1/2 times their gross annual income. However, keep in mind that lenders are often willing to approve a larger loan than homebuyers feel they could comfortably afford or want to assume.

- People should spend no more than 28 percent of their gross monthly income on housing expenses. (Monthly housing expenses include the principal, interest, property taxes, homeowners insurance and private mortgage insurance, when required).

- Monthly housing expenses and other long-term debts should not exceed 36 percent of a household's gross monthly income.

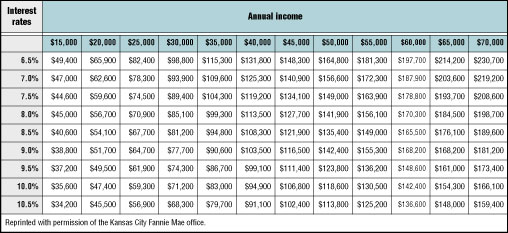

Amount of mortgage for which you might qualify by Fannie Mae Foundation

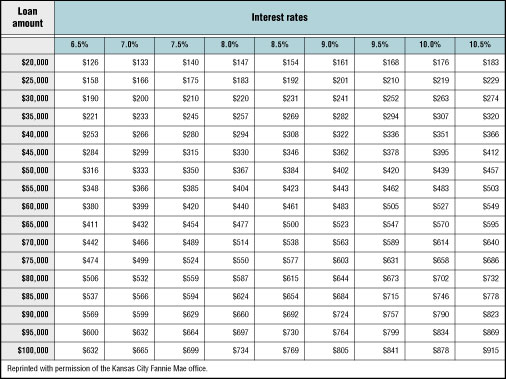

Monthly interest you would pay on your mortgage by Fannie Mae Foundation

The chart from the Fannie Mae Foundation shows the amount of mortgage for which you might qualify, given current interest rates and your annual income. This chart assumes that 25 percent of the gross monthly income is put toward housing expenses, leaving three percent of the allowable 28 percent for taxes and insurance. However, this chart does not take debt and other factors into consideration, which can have a major impact on the loan amount.

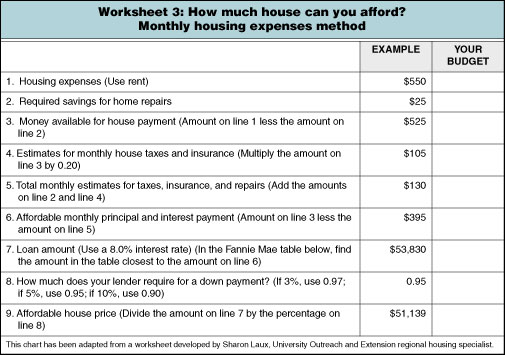

You know your budget better than the lender does, and you may have monthly expenses that a lender would not take into consideration. For this reason, another way to assess how large a loan you can afford is to determine how much of your monthly income you are willing to assign to housing expenses (Worksheet 3).

Organizing financial records

During the process of getting a home loan, lenders need documentation of identity, income, credit history and so forth. Get your financial records in order before meeting with a lender so you can present him or her with the necessary information. The loan document checklist will help you get organized.

Credit considerations in home buying

When a person applies for a mortgage loan, the lender looks at a variety of factors to determine whether the borrower is likely to pay back the loan.

When a person applies for a mortgage loan, the lender looks at a variety of factors to determine whether the borrower is likely to pay back the loan.

The five Cs of credit

- Character

You need to be honest and responsible about repaying the loan. To assess your character, the lender will order a copy of your credit report to see how well you have paid off previous debts and if you pay your bills on time. A steady job history, defined as having continuous employment for two years or more, is another indicator of good character. - Capital

Capital refers to a person's assets. Assets include savings, investments, life insurance, personal property and home equity. You must have enough resources to obtain a mortgage. - Capacity

You must prove that you are capable of paying back the loan, given your current income and other debt payments. If the lender decides you cannot afford to make the monthly payments on the home you want to buy, you will need to renegotiate the terms of the loan or wait to purchase a home until your financial situation improves. - Collateral

Collateral is an asset that the lender will take if you do not pay back the loan. When applying for a home loan, the house is the collateral. If you default on the loan, the lender has the right to the deed on the house. - Conditions

Current economic conditions have a bearing on whether the lender will give you a loan or not. If the economy is in a downturn, loan applicants who meet the other criteria still may not be able to obtain a loan.

Understanding your credit report

Credit reports typically cover information in four categories:

- Personal identification

This includes your name, address, Social Security number and employment history. - Payment history

All your credit accounts are listed, along with the amount of your outstanding balance and a record of how well you have made your payments. - Inquiries

The credit report lists all the sources that have requested a copy of your credit information for at least six months. - Public record information

This category includes items that affect your creditworthiness that can be found in public records, such as bankruptcy, foreclosure and liens.

Credit reports are sometimes inaccurate or present a misleading picture of an individual's credit history, so order a copy of your credit report, check its accuracy, and correct any errors before meeting with a lender. For contact information about the major credit reporting agencies, see Credit reporting agencies.

Alternative methods of establishing a good credit history

If you have never had any credit cards or taken out a loan through a financial institution, you may not be able to obtain a traditional credit report. In this case, you will have to put together a "nontraditional" credit history. You can do this by documenting that you pay your bills and other financial obligations on time each month. Put together a file documenting your credit history by collecting copies of cancelled checks and bills that are free of late charges to show the mortgage lender.

Problems with credit

Significant credit problems include having too much debt (more than 20 percent of your monthly income), frequently making late payments, a home foreclosure in the past seven years, bankruptcy in the past 10 years, and repossession of cars, furniture or anything else bought on an installment plan. If your credit report reflects a credit history with major problems, it is probably best to delay buying a home until you improve your credit history.

Significant credit problems include having too much debt (more than 20 percent of your monthly income), frequently making late payments, a home foreclosure in the past seven years, bankruptcy in the past 10 years, and repossession of cars, furniture or anything else bought on an installment plan. If your credit report reflects a credit history with major problems, it is probably best to delay buying a home until you improve your credit history.

Developing a debt management plan.

There are several ways to manage your debts and improve your financial standing and creditworthiness.

- Analyze your income and expenditures. Create a budget and stick to it, cutting out luxuries and unnecessary expenses and allocating the money saved to debt repayment.

- Pay off as many debts as you can before applying for a mortgage, focusing on paying off debts with high interest rates first.

- Try consolidating debt from several credit cards onto one card with a lower interest rate.

- Put your credit cards in a place where you cannot access them so you will not be tempted to increase your debt.

- Cancel unnecessary credit cards in writing to reduce the amount of available credit on your credit report.

- Consider professional help if you feel overwhelmed by your financial situation and are having a hard time paying off your debts. The Consumer Credit Counseling Service (CCCS) offers free or low-cost credit and budget counseling. Call 800-338-2227 for the CCCS office closest to you.

Having enough money for a down payment and other expenses

Saving enough money for a down payment often takes several years for first-time homebuyers. Down payments usually range from 5 to 20 percent of the price of the house, although the required down payment on some loans can be lower. In addition to the down payment, homebuyers need to have enough money to pay the closing costs. Closing costs include a variety of fees that complete the transaction of ownership from the buyer to the seller. Closing costs typically range from two to seven percent of the value of the home. However, you should not spend all your savings on the down payment and closing costs. You will need to have sufficient funds to pay for moving expenses, household furnishings and any emergencies that arise. If you do not have enough money saved to purchase a home, continue to practice good money management skills until you do. For a list of money-saving strategies, see Tips for saving money (right).

Getting prequalified and preapproved for a loan

If you feel reasonably confident that you are ready to buy a house, visit with a lender in order to get prequalified and/or preapproved for a loan. During prequalification, the lender looks at your financial situation (income, assets, long-term debt), puts these numbers through a series of standard formulas, and tells you a loan amount for which you might qualify. This information will help you when you look at houses because you will know the upper limit of your price range. In preapproval, the lender takes this process further by committing to provide you with a certain loan amount, provided you find a house that appraises for at least the amount of money you are paying for it. There are usually application fees when you apply for a preapproval. Getting prequalified and preapproved shows that you are a serious home buyer and helps sellers feel more confident in your ability to actually afford a home.

Finding the home for you

The choices available to potential homebuyers are endless. There are many different kinds of homes with an infinite variety of floor plans. However, before you even begin looking, it is important that you sit down and evaluate your housing needs and desires.

Evaluating needs and desires

Knowing the difference between what you would like to have and what you absolutely need in a home is important and will make the home buying process smoother. Start by making a list of everything you have always wanted in a home. Because this is a "wish list," include anything you want. After doing this, make a second list of everything you absolutely need in a home — features that you could not live without. Consider these areas:

- Size

Determine the number of bedrooms and bathrooms you need to live comfortably. - School district

Homes in better school districts tend to appreciate faster. Select a school district that will meet the needs of your children. - Location

Consider how close the home is to work, schools and other frequent destinations. - Amenities

This includes special features in the home (such as a fireplace or deck) and services in the community (such as a public library, nearby stores and parks).

Because most first-time homebuyers cannot afford the house of their dreams, it is important that the list of needs be realistic. After you have determined what features you need in a home, you are ready to start looking.

Housing alternatives

There are many housing options available to homebuyers. The most common is the single-family dwelling. Single-family homes are the most expensive option on the market, but usually appreciate at the fastest rate, and the homeowner has the freedom to make all the decisions about the property. There are many options in this category with widely varying prices: new, custom-built homes; previously owned homes; and fixer-uppers.

Condominiums and townhouses are usually a less expensive alternative to a single-family home. These kinds of homes typically have less privacy, but homeowners have the benefit of shared amenities, such as tennis courts, grounds and laundry facilities. Homeowners usually have to pay a monthly or annual fee that contributes to the maintenance of the common property.

Buying a multifamily home, such as an apartment building — living in one unit, and renting the others — is another alternative to a single-family house. Income from the renters will likely cover most or all of the mortgage payment, allowing the homeowner to live there very cheaply. However, there is less privacy in this living arrangement and, as the landlord, the owner has more responsibilities.

Manufactured housing is another relatively inexpensive option for the first-time homebuyer. Mobile homes and other types of manufactured housing are usually considerably cheaper than houses that are built on the site itself. However, manufactured homes often depreciate in value over time.

Comparing roofing and siding materials

When looking for a potential home, take note of the kinds of materials used in the construction of the house. Details such as these impact the value of the home and the amount of maintenance necessary to keep the house looking nice.

Evaluating floor plans

When looking at potential homes, make sure the floor plan suits your needs. Things to consider:

- Is the number of bedrooms and bathrooms adequate for the number of people who will be living in the home? Being cramped for space can be stressful on all family members.

- Is there enough storage space in each room for your needs? Experts recommend that the amount of storage space should be 10 to 25 percent of the total floor space of the home.

- Does the kitchen have enough counter and storage space? The layout should enable those preparing food to move about easily and efficiently.

- Will your existing furniture fit into the home? When looking at a potential home, try to imagine how you would fit your furniture in the rooms and how your family would go about its activities in the available space.

- Will your needs change during the time you expect to live in the house? If you anticipate that you will have more children or that elderly parents will come and live with you, make sure that the available space is adequate for your future needs.

Site and location considerations

A home's location is a very important factor to consider. The location of a home in the community and neighborhood can affect its price as much as the features of the home itself.

Make sure you consider the following community factors:

- Amount of property taxes

- Proximity to frequent destinations (work, schools, houses of worship, stores, services, and friends)

- Quality of the school district

- Availability of recreational facilities

- Overall safety level of the area

Considerations closer to the home itself include maintenance of the streets and sidewalks (especially in inclement weather) and the general appearance of neighboring homes. The site itself also has an important impact on the value of the home. The slope of the land, existing landscaping and the amount of privacy should all be given consideration. Community, neighborhood and site factors such as these will have a direct bearing on the home's future resale value.

Home inspection

When you have found a house that you would like to buy, conduct a preliminary inspection of the house before making a purchase offer. Although a thorough, professional inspection will be done after the purchase agreement is signed, inspect the house yourself before drafting a contract to make sure the house is suitable. Take your time and do not be afraid to ask a lot of questions. Buying a home is a huge investment, and you want to get your money's worth. Using the Home inspection checklist can help you through this process.

Environmental concerns

There are many pollutants that can contaminate a home's air and water supply, and so make sure that the house you are considering will be a safe, healthy place in which to live. Ask the seller if he or she is are aware of any problems with the following pollutants in the home:

- Mold, mildew and other biological contaminants (dust mites, roaches, etc.)

- Carbon monoxide and other combustion pollutants

- Lead

- Formaldehyde and other volatile organic compounds

- Asbestos

- Radon. It is good practice to get a radon inspection done by a qualified inspector before purchasing a house to check to see if the radon level is below the acceptable level set by EPA (4 pCi/L).

Refer to sources of indoor air pollution for more information about asbestos, lead and radon.

A professional inspection should reveal indoor air quality problems. You can choose to make your purchase contingent upon a satisfactory inspection of environmental factors.

Professionals in the home buying process

- Real estate agent

Although some people choose to buy a home on their own, it is wise to enlist the aid of a broker. A good broker is an expert in the home buying process and can guide first-time buyers every step of the way. Traditionally, all real estate agents were legally bound to get the best possible deal for the seller and represent the seller's best interests. Recently, buyers' brokers became available to represent the best interests of the buyer. A buyer's broker sometimes requires the buyer to pay an up front fee for his or her services, such as $500 or $1,000. However, if he or she is a good broker, he or she is well worth the investment. Qualities of a good broker include knowing a lot about the local housing market and financing, communicating clearly and frequently, and being flexible. The time to hire a broker is when you are seriously ready to buy a home. Because a good working relationship with a broker is essential, talk to several brokers until you find one with whom you feel comfortable. - Attorney

Attorneys are relatively expensive, but their services are well worth the cost. An attorney can help prepare the offer to buy the house, perform the title search, take part in the closing, and offer valuable legal advice. He or she should review all documents before you sign them and make sure everything is in order. - Appraiser

When applying for a mortgage, the buyer is required to pay an appraiser to decide the fair market value of the home. The appraiser assesses the house's physical condition and compares it to similar houses that have sold recently to determine its worth. If the appraiser says the house is worth less than the loan amount for which you are applying, you may be required to pay a larger down payment or pass on the house. If the house is appraised for more than you are paying for it, it is likely that you are getting a good deal. - Inspector

A very common contingency in purchase offers is that the house be found satisfactory by a professional inspector. An inspector will examine the house for structural and mechanical problems. A professional inspection usually costs a few hundred dollars but is very important, as the inspector will be able to notice problems that you and your broker may have overlooked. If there are problems with the house, you can ask the seller to fix them or lower his asking price. If he refuses and you are not satisfied, you can get out of the contract, provided you included a clause about a suitable inspection.

Getting a mortgage

There are several places you can go to obtain a mortgage. Banks and savings and loan institutions are the traditional sources of mortgages and have many different kinds of loans and programs. Mortgage companies are solely in the mortgage business and usually have a variety of products with competitive interest rates. Credit unions are another source of mortgage loans, although the buyer must be a member of the credit union to benefit from its services. Your real estate agent or broker should be able to give you information about local lenders and the loan products they offer.

There are several places you can go to obtain a mortgage. Banks and savings and loan institutions are the traditional sources of mortgages and have many different kinds of loans and programs. Mortgage companies are solely in the mortgage business and usually have a variety of products with competitive interest rates. Credit unions are another source of mortgage loans, although the buyer must be a member of the credit union to benefit from its services. Your real estate agent or broker should be able to give you information about local lenders and the loan products they offer.

Conventional loans

Lenders use the term "conventional" for loans that require at least a five percent down payment and are not administered through the government.

- Fixed-rate mortgages (FRMs)

Fixed-rate mortgages ensure that the interest rate will remain the same over the life of the loan. The advantage to FRMs is that the buyer has predictable, stable payments of principal and interest for the duration of the mortgage. However, they usually have higher interest rates than other types of mortgages. FRMs usually have a variety of repayment periods from which to choose, such as 15, 20 or 30 years. - Adjustable-rate mortgages (ARMs)

Adjustable-rate mortgages have interest rates that fluctuate according to current market conditions. ARMs usually offer a lower initial interest rate than fixed-rate mortgages, but the amount of mortgage payment changes periodically (every six months or a year). ARMs typically have a cap on the amount the interest rate can increase in each adjustment period (usually two percentage points) and over the life of the loan (usually five or six percentage points). The main disadvantage to this type of loan is that if interest rates increase significantly, the monthly mortgage payment will also increase substantially. However, there are many variations on the standard adjustable-rate mortgage. Some ARMs allow you to convert to a FRM for a small fee. Others do not begin adjusting the initial interest rate for several years. Other ARMs adjust only once, usually after five to seven years. - Balloon mortgages

Balloon loans offer a fixed interest rate for a short period of time, usually five to 10 years. At the end of the period, the entire remaining balance on the loan is due. Balloon mortgages are a possibility for individuals who anticipate they will sell or refinance their house after a few years. However, although some lenders will allow the buyer to refinance the loan at the end of the fixed period, others will not. It is important to understand all the terms of this type of loan before committing to the prospect of having to pay off the entire loan in just a few years. - Graduated payment mortgage (GPM)

The graduated payment mortgage has a low, fixed interest rate for the first few years of the loan. After the set period, the interest rate rises over a period of five to 10 years and then remains constant for the rest of the loan's life. This type of loan may be a good option for first-time buyers who anticipate that their earning power will increase over the life of the loan.

Non-conventional loans

Governmental and other agencies offer special mortgage products for specific groups of people, such as first-time homebuyers, individuals with a low income, and veterans. Some of these agencies include:

- U.S. Department of Housing and Urban Development (HUD)

- Fannie Mae

- Veterans Administration (VA)

- Federal Housing Administration (FHA)

- USDA Rural Development

These agencies and others offer assistance to people who might not otherwise be able to afford a home of their own. These loans typically have lower interest rates and require lower down payments to individuals who qualify. However, there are usually very specific requirements on property standards and the maximum amount of the loan. Missouri Housing Partners is a group of state and federal agencies who work with individuals to finance a home. Individuals who may qualify for their programs include those who are first-time homebuyers, of low to moderate income, disabled, veterans or senior citizens. For more information about non-traditional mortgage options, contact the Missouri Housing Development Commission at 816-759-6600 or visit their website.

Factors affecting the cost of a loan

Interest rates and points

Because mortgage loans have such a long life (often 30 years), a slight difference in the loan's interest rate can make a big difference over the life of the loan. Even a quarter of a percent (0.25 percent) can increase or decrease the total amount of interest paid by thousands of dollars. In order to lower the interest rate of the loan, many lenders allow the buyer to pay "points" up front. A point is equal to one percent of the amount of the loan. For example, one point in a $100,000 loan would equal $1,000. By paying points at closing, the interest rate may be dropped enough to make a significant difference. If you plan to be in your home for at least five to seven years, it may be well worth the extra cost at closing to pay points if it will significantly reduce the amount of interest paid over the repayment period. However, if you anticipate you will only be in your home for a few years, paying points may not be to your advantage.

Repayment periods

Besides the interest rate, another important factor in your loan agreement is the repayment term. Most people pay off their mortgages over 30 years. This is a long time to pay off a loan, but it requires lower monthly payments than a 15- or 20-year loan. However, with a shorter repayment period, the buyer pays significantly less interest over the life of the loan. For example, with a $100,000 loan at an 8.25 percent interest rate, a buyer will pay $75,000 interest in a 15-year loan; $105,000 interest in a 20-year loan; and $170,000 interest in a 30-year loan. The choice in the length of the repayment period depends on how low you want your monthly payment to be, how quickly you want to pay off your mortgage and what monthly payment you can afford.

Besides the original term of the mortgage, your payment schedule can make a difference in how fast you pay off your loan. Most mortgages require 12 monthly payments per year. However, some lenders allow you to make 26 biweekly payments throughout the year. This amounts to making an extra monthly payment each year. This will save you considerable money in interest and you will pay off the loan much more quickly. Make sure your loan contract will not penalize you for making prepayments. Paying even $25 extra a month will save a lot of money, as any extra money paid over the set monthly payment directly reduces the principal.

Comparing loans among lenders

Making home loans is a competitive business, and it is to your advantage as the homebuyer to shop around for the best deal you can find. Taking the time to find a loan with the best annual percentage rate (APR) will likely translate into saving thousands of dollars over the life of the loan. Contact several lending institutions and compare the terms of the loans in which you are interested.

Because there are so many variables to consider in a mortgage, keep detailed notes of your conversations with the loan officers you talk to. Compare the options that will make the best deal for you. As you will be working closely with a loan officer and other employees as you negotiate the terms of your contract, make sure you find a business that you feel comfortable with. Once you have decided upon a lending institution, you can begin the process of filling out the mortgage application and getting approved.

Making an offer

Negotiating the purchase

Because the purchase of a home is often the largest investment people make, it is important to carefully negotiate the purchase price and details of the contract in order to obtain the best deal possible. If you have done your homework along the way, you should be in a strong position to negotiate a purchase contract that will meet your needs. Being aware of local economic trends and the value of comparable homes that have sold recently will help you negotiate a reasonable price for the home. Consider these negotiation tips:

- Know why the seller is moving. This can be very helpful in determining how flexible she or he will be in lowering the asking price of the home.

- Sellers usually pad the asking price of the home so they will be more likely to receive the price they really want. Make an offer lower than the asking price, based on the estimated market value and how fast homes are selling in the area.

- Keep a "poker face" when visiting potential homes, as everything the seller and his or her broker hear will be used in the negotiation process.

- Only respond to counteroffers if they are in writing. Peruse them at your leisure, away from the seller's agent. This will prevent you from feeling pressured to make changes to your offer on the spot.

- Sign contracts and agreements only after you have read them carefully and thoroughly.

- Be prepared to bargain for the price and conditions you desire. Expect to compromise, but know your limits.

Purchase agreement contract

Once you have found a home that is right for you, you will submit a purchase agreement to the seller. A buyer's broker can help you draft this contract, but your best bet is to work with an attorney who has a good knowledge of real estate law. Your purchase offer will include how much you are willing to pay for the home and a variety of contingencies. Contingency clauses are your conditions and terms of the agreement. If any of them are not met, you can withdraw your contract or negotiate for a lower price. It is very important to draft a well-written, thoughtful contract, because once the seller signs it, the contract is legally binding. The following is a list of common contingencies that buyers include in their contracts:

- Financing

This clause outlines the type of financing you wish to obtain, including the loan amount, down payment, interest rate, points and other exact terms of the mortgage. If you are unable to obtain these terms, the purchase contract is voidable. - Inspection

Many homes have at least one serious, costly defect. This clause states that you will pay for a professional inspection of the home. If defects are found, you can withdraw your offer, negotiate a lower price or have the seller fix the problem. - Appraisal

This allows you to withdraw your offer or ask that the price be lowered if the appraiser rates the house lower than the price you have agreed to pay. - Personal property

Typically, anything that is not permanently connected to the house is considered personal property. If you would like the seller to leave major appliances, window treatments, light fixtures and so forth, list them in the contract.

There are many other possible contingency clauses that you may want to include in the contract, depending upon your needs. After you are finished with the contract, it will be submitted to the seller for his approval. The seller may agree to the price and terms and sign the contract, making it legally binding on both of you. More commonly, the seller does not accept the initial offer and will present a counteroffer to the buyer. The original offer is then cancelled, and the buyer must decide whether or not to accept the new agreement. It is common for counteroffers to be presented several times until both the buyer and seller are satisfied. If a final offer is agreed upon, the buyer will proceed to uphold his end of the contract by obtaining a mortgage loan, setting up an inspection, arranging for homeowner's insurance and so forth. Once all the contingencies and requirements have been satisfied, the deal will proceed to the closing process.

Closing

Closing is the legal process through which the buyer becomes the official owner of the property. It involves a formal meeting attended by the buyer and seller, their respective brokers and attorneys, and a representative from the mortgage institution. Several important aspects of the closing process are discussed in this section.

Closing costs

Closing costs include all the fees charged by the lender to process the mortgage. Lenders are legally required to give buyers a good faith estimate of the amount of the closing costs no more than three business days after a person fills out a loan application. Closing costs also include all fees to the individuals who provide services through the sale and purchase of the home. Specific closing costs may include the following:

- Loan application fees and credit report;

- Loan origination fee;

- Points;

- Title search and insurance fees;

- Attorney fees;

- Appraisal fees;

- Professional inspection fees;

- Survey costs;

- Prepaid interest on the loa

- Recording fees.

Closing costs range anywhere from two to seven percent of the purchase price of the home (this does not include the down payment). The buyer usually pays for most of the closing costs. However, some fees are negotiable and the purchase agreement can state which of the closing costs the seller will pay.

Title insurance and search

A title states who has legal ownership of a piece of property. When buying a house, the buyer must be able to prove that the seller actually owns the house in order for the lender to approve the mortgage. In order to do this, a real estate attorney or title insurance company will conduct a title search, which involves searching public records to determine that the seller has the legal rights to the property. The title search reveals whether anyone else has rights to the home through judgments, liens or unpaid taxes. The seller is usually responsible for paying for the correction of any problems with the title.

In addition to a title search, the lender also requires that the buyer purchase a title insurance policy to protect the lender against defects in the title. Title insurance can also protect the buyer from other people claiming rights to the property. Title insurance involves a one-time cost to the buyer and is usually based on the amount of the mortgage.

Private mortgage insurance (PMI)

Private mortgage insurance is usually required if the loan amount is greater than 80 percent of the appraised value of the home (i.e. if you make a down payment less than 20 percent of the purchase price). It protects the lender should the buyer default on the loan. PMI is usually paid each month, adding an additional cost to the monthly payment. Homeowners may drop private mortgage insurance after two years if they make home improvements and increase the equity in their home to 20 percent of the original appraised value or whenever they have paid 20 percent of the loan principal.

Final walk-through

Within 24 hours of the closing date, you should inspect the house you are buying, one last time, to make sure that everything is in order. Your purchase agreement should state your intention to do this. This is your chance to make certain that any agreed-upon repairs were made to your satisfaction, to ensure that all appliances and systems work, and to check for any new damage to the home. It is likely that everything will be fine and you will be able to proceed with the closing. However, if there are problems, it is much better to discover them before the deal is finalized and you own the home. It is possible to sue the seller afterwards if you encounter major problems or breaches of the contract, but this is a very costly and time-consuming process. It is far better and wiser to take an hour to walk through the home before closing and deal with any problems before the house is your responsibility.

Closing procedures

The formal closing meeting, or settlement, is conducted by the closing agent, who may be a real estate broker, attorney, representative from the lending institution or someone else. The main activity that takes place at the closing is reading and signing all the official documents required to transfer the ownership of the home from the seller to the buyer. The closing costs are also paid at this meeting, so make sure you bring enough money for all the required fees. Some expenses must be paid with a certified check or money order, and others can be paid with personal checks. If you have already paid some of the closing costs, bring receipts to show that you have paid them. If all goes well, the seller will give you the keys to your new home, and you will officially be a homeowner.

Protecting your investment

After having spent a great deal of time, energy, and money to become a homeowner, it is important that you protect your investment. This final section discusses three ways to do this.

Obtain sufficient homeowners insurance

Homeowners insurance protects you from losses you could not otherwise afford. Homeowners insurance policies cover three basic areas:

Structure of the home and detached buildings on the property

Your home and adjacent buildings on your property are insured if they are damaged or destroyed by fire, hail or other disasters. You should insure your home for at least 80 percent of the current replacement cost. Buy a policy that covers a wide range of perils. The most common insurance policy is HO-3, a comprehensive policy that covers all perils except those that are specifically excluded, such as earthquakes or flooding. Depending on where you live in Missouri, it could be well worth the extra cost to purchase earthquake or flood insurance. Homeowners insurance will also cover additional living expenses if the home is damaged so extensively that you must live elsewhere until it is repaired or rebuilt.

Contents of the home

The contents of your home are also covered up to a specified dollar amount if they are destroyed or damaged. A standard amount of personal property coverage is 50 percent of the amount of insurance on the home. Take an inventory of all your belongings and keep this list in a safe place away from your home. This makes it much easier to prove what needs to be replaced in the event that you have to make a claim. Make sure your belongings are insured for their replacement cost, not the actual cash value of the items. This will enable to you replace your belongings at current market prices instead of receiving the amount of what they are actually worth (which is probably a lot less). If you own expensive items, such as jewelry or valuable antiques, you can add special endorsements to cover the property beyond the amount specified in the original policy.

Liability protection

Your homeowner's insurance policy will also protect you if someone is accidentally injured on your property or you injure someone elsewhere. This covers the injured person's medical payments and damage to their property. The minimum recommended coverage is $100,000 per person per accident.

Practice preventative maintenance

Keeping up with home maintenance and repairs is an important responsibility of homeowners. As time passes, the structural materials of a house will need to be repaired or replaced. Plan to inspect your house each year for necessary repairs. Keep records of when repairs are made and how much they cost. This information may be useful at a future time when you decide to sell your home. Experts recommend saving between one and three percent of the home's market value for repairs and maintenance each year. Your home will probably not require expensive repairs each year, but as this money accumulates, you will be able to afford larger maintenance expenses when the need arises, such as installing a new roof or repainting the house.

Keeping up with home maintenance and repairs is an important responsibility of homeowners. As time passes, the structural materials of a house will need to be repaired or replaced. Plan to inspect your house each year for necessary repairs. Keep records of when repairs are made and how much they cost. This information may be useful at a future time when you decide to sell your home. Experts recommend saving between one and three percent of the home's market value for repairs and maintenance each year. Your home will probably not require expensive repairs each year, but as this money accumulates, you will be able to afford larger maintenance expenses when the need arises, such as installing a new roof or repainting the house.

Avoid foreclosure

Foreclosure is something that no homeowner wants to face. It involves the lender taking and selling the property after the homeowner failed to meet his or her side of the mortgage contract. Because having a foreclosure on your credit report will likely ruin your credit rating for years, if you are having a hard time making your mortgage payments, it is essential that you take whatever measures are necessary to avoid foreclosure.

Making monthly housing payments can be very difficult if you have lost your job, have accumulated large medical bills or have experienced any other major misfortune. The first thing to do in such an event is to talk to the lender and explain your situation. Be truthful and tell him why you are having a hard time making your payments on time. Describe your financial assets, expenses and other debts. Even if your situation looks hopeless, do not give up. Dealing with foreclosed property usually results in a significant loss of money for the lender, so he will probably try to help you as much as he can. Possible solutions include developing a more affordable repayment plan, temporarily suspending monthly payments or allowing you to only make interest payments, applying any prepayments you have made to the outstanding payments, referring you to a debt counseling agency, and modifying the terms of your mortgage agreement.

Additional information

- Department of Housing and Urban Development — Buying a Home

- Fannie Mae

- Federal Trade Commission

- Freddie Mac

- HomeAdvisor

- HomePath

- Missouri Housing Development Commission

- Missouri Housing Partners

- Mortgage Banker's Association of America

- Quicken Loans Home Buyers Guide

- USDA Rural Development — Rural Housing Service

References

- American Bankers Association, National Foundation for Consumer Credit, and Neighborhood Reinvestment Corporation. (1995). Realizing the American dream: A workbook series for first-time homebuyers (Vols. 1-4). Washington, DC: Authors.

- Fannie Mae Foundation. (1996). Choosing the mortgage that's right for you. Washington DC: Author.

- Fannie Mae Foundation. (1998). Opening the door to a home of your own. Washington, DC: Author.

- Glink, I. R. (1996). 10 steps to home ownership: A workbook for first-time buyers. New York: Times Books.

- Hassig, L. (Ed.). (1996). Home repair and improvement: Roofs and siding. Alexandria, VA: Time-Life Books.

- Israelsen, C. L., & Weagley, R. O. (1997). Personal and family finance workbook (third edition). Dubuque, IA: Kendall/Hunt Publishing Company.

- Kobliner, B. (1996). Get a financial life: Personal finance in your twenties and thirties. New York: Simon & Schuster.

- Laux, S. (1999). Development of financial assessment worksheets.

- Leonard, R. (2000). Money troubles: Legal strategies to cope with your debts. Berkeley, CA: Nolo.com, Inc.

- Louisiana Cooperative Extension Service. (1997). Your path to home ownership. Baton Rouge, LA.

- McCarty, J. A. (Ed.). (1991). Home buyers' Guide: Financing and evaluating prospective homes. Ithaca, NY: Natural Resource, Agriculture, and Engineering Service (Cooperative Extension).

- Peart, V. (1995). A house for your family: Buy or rent? University of Florida Cooperative Extension Fact Sheet HE 3215.

- Peart, V. (1995). Finding your house. University of Florida Cooperative Extension Fact Sheet HE 3218.

- Peart, V. (1995). Home purchase contracts. University of Florida Cooperative Extension Fact Sheet HE 3223.

- Peart, V. (1995). How to prevent foreclosure on your home. University of Florida Cooperative Extension Fact Sheet HE 3227.

- United States Department of Housing and Urban Development. (1987). Home buyer's vocabulary. [Brochure]. Washington, DC: Author.

- Woodson, R. D. (1992). The complete guide to buying your first home. Cincinnati, OH: Betterway Books.

Copy of Social Security card and driver's license or other photo ID

Copy of Social Security card and driver's license or other photo ID

People have the right to buy or rent any home they can afford, in any neighborhood. The Fair Housing Act makes it illegal to deny someone the right to rent or buy a home based on race, color, national origin, religion, sex, handicap or familial status (families with children). Anyone who has control over residential property and real estate financing (landlord, real estate agents, builders, lenders and individual homeowners) must abide by this law. If you feel you have been discriminated against, address the people involved with your concerns. If this route is ineffective, contact the Missouri Commission on Human Rights toll-free 877-781-4236 or visit their

People have the right to buy or rent any home they can afford, in any neighborhood. The Fair Housing Act makes it illegal to deny someone the right to rent or buy a home based on race, color, national origin, religion, sex, handicap or familial status (families with children). Anyone who has control over residential property and real estate financing (landlord, real estate agents, builders, lenders and individual homeowners) must abide by this law. If you feel you have been discriminated against, address the people involved with your concerns. If this route is ineffective, contact the Missouri Commission on Human Rights toll-free 877-781-4236 or visit their